Table of Content

Look no further if you want to improve your 597 credit score by applying for a secured credit card. There are several ways you can improve your credit score once you understand how credit scores work and how they’re calculated. Like home and car loans, a personal loan and credit card is difficult to get with a 597 credit score. Because you might have a better chance at getting approved for a store credit card with poor credit. The potential downside is that these cards tend to come with high interest rates, and you may only be able to use them at a specific store. On the other hand, they might offer rewards and benefits that make sense if you already shop at the store in question.

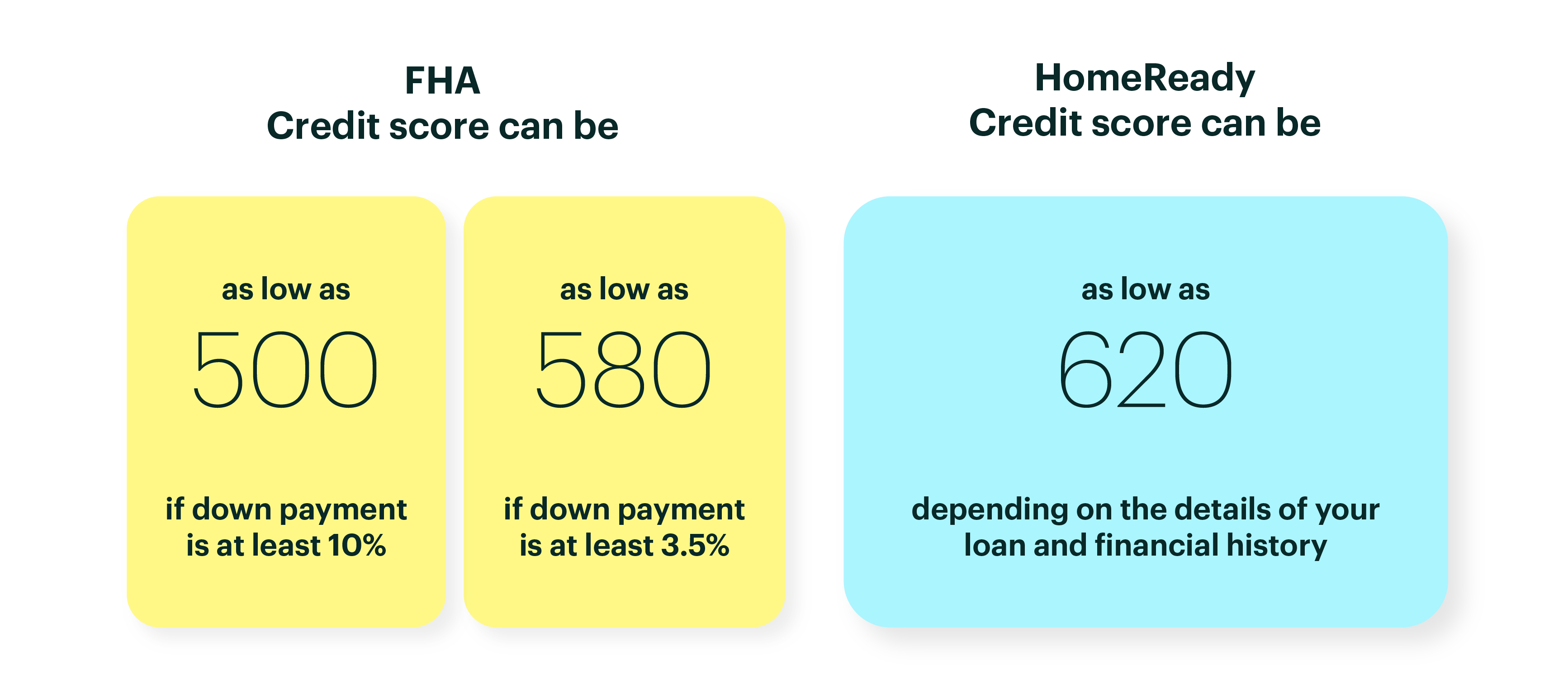

First time home buyer with credit score below 580 must make a minimum 10% down payment of the purchase price and a seller concession of up to 6% to pay for closing cost is allowed. But no matter the cause of your Fair score, you can start handling credit more, which can lead in turn to credit-score improvements. There's not much new credit users can do about that, except avoid bad habits and work to establish a track record of timely payments and good credit decisions. Length of credit history can constitute up to 15% of your FICO® Score. You may be eligible for some cards that people with extremely bad credit wouldn’t be able to get. However, it’s safest to pick cards with a pre-approval process so there’s no risk of being rejected and triggering a hard inquiry, which will cause your score to temporarily drop.

How Your 599 Credit Score Was Calculated

When you have a 310 FICO score or something close to that, the truth is that what you have is a low credit score. Having a bad credit score means that you have been consistently found wanting when it comes to handling your financial life. It is advisable that you check through all three bureaus in order to be sure that there is no mistake somewhere about your credit. The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 597 FICO Credit Score and your VantageScore.

Many prospective home buyers assume that your credit must be in the 600s or 700s to get a mortgage. This is certainly not the case, as many mortgage lenders offer home loans to borrowers with credit scores as low as a 500. In case things get so bad that you are unable to get a personal loan with 310 FICO score or you want another option you can check out, you can go for a payday loan. A payday loan is a short-term loan that requires the personal check of the borrower. The check will be held by the creditor until you have been able to pay back. This can also be done by signing over electronic access to your bank account to receive and repay payday loans.

How To Get Rid Of Missed Payments On Credit Report

In 7–10 years, your 597 score is guaranteed to have fully recovered from any mishaps in your past, provided you’ve taken the right steps to rebuild your credit. A credit score of 597 is higher than the lowest credit score of 300, but it’s still a long way off from the highest credit score of 850. In the main scoring models used by US credit bureaus, 597 is in either the “fair” range or the “poor” range . If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

Re-check your credit score first – the accuracy of your credit score is important when it comes to getting a personal loan. Payday loans can be easily gotten when compared to Personal loans. Your credit score does not matter before you can get Payday loans.

Home Equity

You can spend less, make bigger payments or pay your bill multiple times per month to bring down your statement balances. You can also request higher credit limits, but that’s harder for you to control. As of April 2021, 12.5% of Americans have credit scores in the “Fair” range. There’s no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, it could be difficult to get approved for a car loan.

But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. Although you’re in the fair credit range according to FICO, your choices will still be limited to secured credit cards, or unsecured credit cards with high fees and interest rates. That’s because unfortunately, credit card companies still treat fair credit as subprime.

Is a 625 Credit Score Good or Bad?

That refers to the ability of a borrower to draw money, repay it and draw more. That process can be repeated throughout the life of the line of credit, which in most HELOCs is 10 years. The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

However, before you worry about improving your credit score, it’s important to make sure you’re not doing anything to damage it. You can save a ton of headache by repairing your credit and waiting a few short months until your score improves. A secured card with Discover or Capital One might be an option, but you may have to pay $500-$1000 just for a deposit. The fine print is confusing and more often than not you’ll end up in a worse situation than before you got your secured card. After a few short months of repairing your credit , you’ll be in a much better position to get your ideal home loan terms.

Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past. Just be careful you’re not getting into more debt in an attempt to improve your credit score. Not everyone has the ability to do FHA loans, so pick a a local, reputable, FHA approved lender. If you have other positives to offset the negative credit score, like a large 401K or long time on the job…make that known from the outset. New borrowers with less than a 580 credit score will be required to put down at least 10%.

Even with the best auto loans for poor credit, watch out for high interest rates, which can make it very expensive to borrow money. Because secured cards pose less of a risk for credit card issuers, they may be more readily available to someone with poor credit. And a secured card can benefit you as a borrower if the lender reports your on-time payments and other credit activity to the three main credit bureaus.

While everyone’s situation is unique, you should generally be wary of these short-term loans that come saddled with high fees and interest rates. They can quickly snowball into a cycle of debt that’s even harder to climb out from. You might find it challenging to get approved for a personal loan with poor credit scores. With a poor credit score, you might have trouble qualifying for credit. Maybe you’ve already been rejected for a credit card you’ve had your eye on, or maybe you only seem to qualify for loans with high interest rates and fees.

Others might agree to your loan request, but they'll probably charge you outrageous fees and interest rates. As a result, you will pay more interest rates than someone whose credit score is in the good range. Applying for a secured credit card might be your best bet if your credit still needs some work. So if your security deposit is, say, $300, your credit limit may also be set at $300. This gives the issuer some insurance in case you close the account without paying off your debt.

Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. Debt consolidation, debt settlement, and bankruptcy are all possible solutions that can help you get out of debt. It's important to weigh your options and choose the solution that is best for your unique situation. I’ve done it before but I just can’t remember how to get a free credit report if i’ve recently been denied credit. Zolve Innovations Inc. is a financial technology company, not a bank or lender.

If your credit score is below 580 new FHA changes require a 10% down payment. The down payment funds can be the borrowers own funds or a gift from a family member and up to a 6% seller's concession is allowed. Borrowers with credit score above 580 require a 3.5% down payment. With such low odds of getting approved for an auto loan, you will need to compare your options carefully and consider either placing a bigger down payment or purchasing less expensive vehicle. In the old days, FHA did not have a minimum credit score requirement. Offer pros and cons are determined by our editorial team, based on independent research.

No comments:

Post a Comment